how to report coinbase on taxes

Simply follow the steps below to get your public address and your tax forms will be ready shortly. This also means that any losses if recorded properly may be deductible from your bill.

How The Irs Knows You Owe Crypto Taxes Tax Refund Get Cash Now Irs

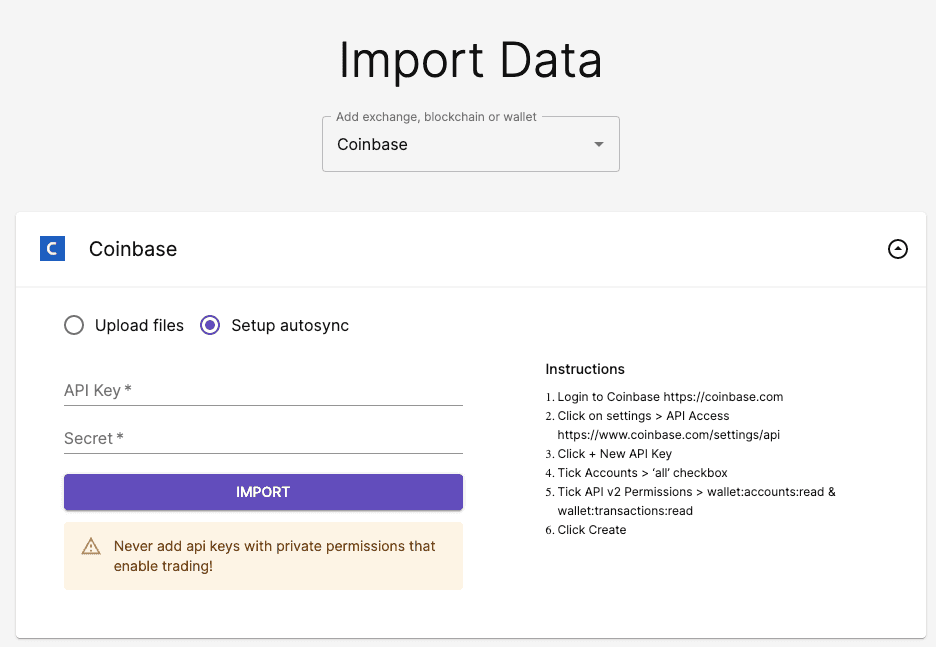

Look for a history export option in Coinbase Wallet that will create a CSV file containing all your transaction data simply import it into Koinly and you can create your tax form.

. This tax season Coinbase customers will be able to generate a GainLoss Report that details capital gains or losses using a HIFO highest in first out cost basis specification strategy. The Coinbase Transaction History CSV file contains a record of all of your buys sells transfers and investment activity that occurred within your Coinbase account. Coinbase will only send you Form 1099-MISC if.

The last option is to manually add transactions one by one from the Transactions page. Import txf file into Turbotax Desktop. So when does Coinbase report to the IRS.

Coinbase will also provide a copy of the form to its users aka you and as a taxpayer it is your duty to report all taxable activities while reporting taxes. Even if you dont qualify for this form you are still required to report all cryptocurrency transactions to the IRS. Crypto can be taxed in two ways.

Each transaction can be edited as well. Even if you didnt receive a form your crypto trades must still be reported to the IRS. Should have earned 600 or more in rewards or fees from Coinbase Earn USDC Rewards andor.

This entry can now be edited to include the account details. Navigate to your Coinbase Pro account and find the option for downloading your complete transaction history. Cryptocurrency sold exchanged spent or converted is treated as sale of property.

File Import From Accounting Software Other Financial Software TXF file Continue Choose a File to Import Import now. Does Coinbase report to the IRS. You can do your taxes manually by calculating your cost basis gains and losses.

In most tax jurisdictions the following transactions are treated as taxable events. When required by the IRS the crypto exchange or broker you use including Coinbase has to report certain types of activity directly to the IRS using specific forms and provide you with a. Fill out IRS Form 8949 for all events taxable as property.

Transfer totals from you 8949 form to your Form 1040 Schedule D. Proper taxation of cryptocurrency gains and losses. You accounted to 600 or more from rewards profile or staking crypto in the past tax year.

Yes they dont send it. Coinbase used to issue these forms automatically but no longer does. A US person for tax purposes.

Import your transaction history directly into CoinLedger by mapping the data into the preferred CSV file format. Selling your crypto for cash. Using crypto to pay for goods and services.

A 1099-B with all Crypto transactions is now created. Either as income a federal tax on the money you earned or as a capital gain a federal tax on the profits you made from selling certain assets. Youre taxed on only your profit when you sell so Sale Price - Cost Basis is the taxable income.

How to report cryptocurrency on your tax return. If you never sell you never owe taxes on it. Its probably below their limit to send a 1099-misc or similar 1099.

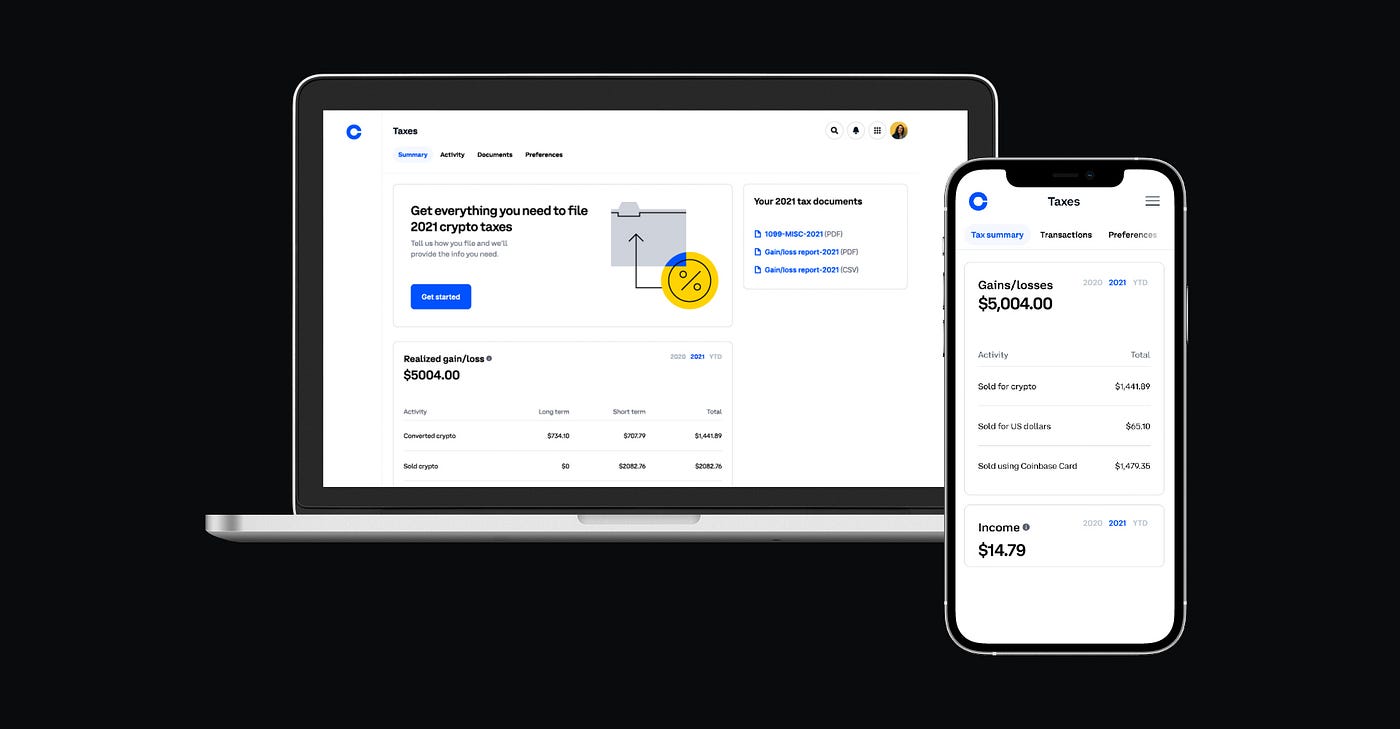

Coinbase tax reporting takes place well ahead of the annual tax season and crypto taxes occur at the same time as income taxes. Coinbase will report your transactions to the IRS before the start of tax season. Coinbase one of the largest and most popular cryptocurrency exchanges is adding a new tax center to its app and website to help US customers work out how much.

Click Generate Report for CSV report and click Download when the file is ready. Any realized gains resulting from exchanging crypto assets into fiat will be taxable. There are a couple of ways you can do this.

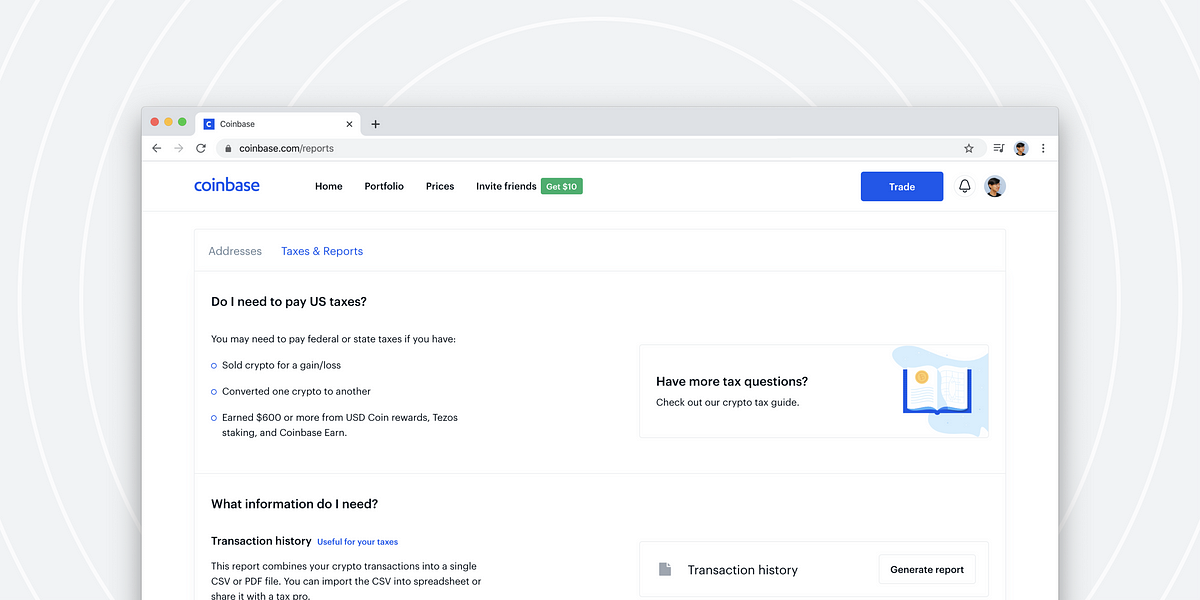

If there are no sales there will not be a reportable Capital GainLoss transaction on your income tax return. Go to the Reports page by clicking the user icon in the top header and click Reports. Coinbase does offer reports to help you accurately report your taxes.

The Coinbase tax report API is read-only so you dont need to worry about another app having access to your Coinbase account. If youd rather avoid the Coinbase tax report API you can download the CSV file of your Coinbase trading history using the steps above. You only pay tax when you sell.

Binance turbotax kraken turbotax cashapp bitcoin taxes bithumb turbotax crypto tax code crypto trading taxes crypto exchanges IRS reporting altcoin taxes bitcoin taxes bitcoin trading taxes crypto trading taxes sync crypto exchanges with turbo tax automated crypto tax calculator crypto tax calculator free crypto tax filing file. You can also upload a CSVExcel file instead of connecting your account with the public address by following the steps explained below. Form 1099 reports your third-party transactions to the IRS.

Yes youll need to report your cryptocurrency capital gains and losses on your taxes because even if you do not Coinbase does report your crypto activity to the IRS if you meet certain criteria you should be a Coinbase customer. The limit is 600. Calculate your capital gains and losses.

Upload the file to. This report is designed to help taxpayers quickly and easily understand their gains or losses for the tax year using our. However if the 50 was paid to you for some service that you performed it would be considered income and would be taxed in that way.

Click the Generate report button. If you prefer to have Koinly sync your transaction data automatically you can create separate Koinly wallets for each of. Coinbase no longer issues 1099-K or 1099-B for its traders as of the 2020 season.

When you fulfill the above conditions Coinbase like other. Its the form used for crypto exchanges because it doesnt simply detail profits it lists the transactions and the gross exchanges in explicit terms. Gather a list of all your exchanges and transactions including any 1099 forms exchanges sent you Step 2.

Download your transaction history from Coinbase to view and file your statement so. So if you sold for 1000 and bought for 50 you owe taxes on 950 profit. Leave the default settings All time All assets All transactions or specify the report you want.

They now only have Form 1099-MISC for those who qualify. The only form they still issue is 1099-MISC probably to streamline their tax services. Youre a crypto trader in the US.

Coinbases new tax dashboard. Place it in other income if the software ask if this was earned income the answer is no. Yes but for those accounts that are eligible as per IRS Forms 1099-MISC.

CoinLedger automatically generates your gains losses and income tax reports based on this data. Op 28 days ago.

Crypto And U S Income Taxes When And How Is Crypto Taxed As Income Coinbase

Coinbase Debit Card Tax Guide Gordon Law Group

3 Steps To Calculate Coinbase Taxes 2022 Updated

Coinbase Downloading Tax Reports Beta Youtube

Coinbase 1099 Guide To Coinbase Tax Documents Gordon Law Group

Crypto Exchange Coinbase Set To Expand Operations In India In 2021 Securities And Exchange Commission Cryptocurrency News Blockchain Technology

The Ultimate Coinbase Pro Taxes Guide Koinly

Cryptocurrency Exchange Coinbase Introduces A New Tax Calculator Cryptocurrency Trading Cryptocurrency Calculator

Crypto Exchange Coinbase Adds Support For Xrp On Retail Platform And Mob Buy Cryptocurrency Supportive Investing Money

The Complete Coinbase Tax Reporting Guide Koinly

Coinbase Is Now Your Personalized Guide To Crypto Taxes By Coinbase The Coinbase Blog

Cryptocurrency Tax Tips Until Tax Relief Passes Expert Blog Crypto News Bitcoin Regulation Coinbase Cryptocurrency Cryptocurrency News Bitcoin Mining Software

Coinbase Resources For 2019 Tax Returns By Coinbase The Coinbase Blog

Did You Trade Crypto In 2018 If So You May Owe Taxes If You Re A Us Taxpayer Here Are Steps You May Have To Take What Forms You Ll Tax Guide

Coinbase 1099 What To Do With Your Coinbase Tax Documents Lexology

![]()

Coinbase Makes It Easier To Report Cryptocurrency Taxes The Verge

Tax Forms Explained A Guide To U S Tax Forms And Crypto Reports Coinbase